Rochester's Best Attorney Answers Common Bankruptcy FAQs

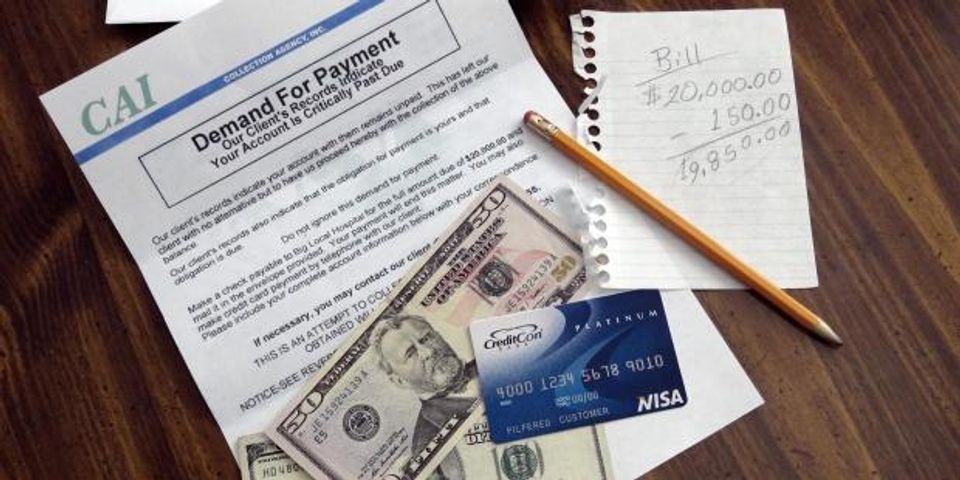

When the phone won’t stop ringing because collections agencies are calling, and your mailbox is filling up with more bills than you can count, it’s time to figure out a solution. Robert A. Schwartz is Rochester’s most trusted bankruptcy lawyer, and he’s helped hundreds of people just like you hit the restart button on their finances and get rid of their debt once and for all. Because bankruptcy can be a complicated process to navigate, he's here to answer some of the more common questions about bankruptcy.

- If I file for bankruptcy, can I still keep my house and car? Yes, under NYS exemptions individuals can protect up to $82,775 in equity, and couples can protect up to $165,550 in equity in jointly owned homes. Federal exemptions allow individuals to protect equity of $22,975 and joint owners are allowed to protect $45,950. Unless the equity exceeds the federal amount, filers will typically use Federal exemptions because they allow a portion of the unused homestead exemption as a wildcard to protect otherwise non exempt assets. The NY car exemption is $4,425 and the Federal amount is $3,675 for each owner.

- Are there any debts that filing for bankruptcy won’t eliminate? Yes. Student loans, child support, criminal fines, penalties, restitution, and recent unpaid taxes will survive and remain your obligation even if you file for bankruptcy. If the taxes are income taxes and are more than a few years old, they may be dichargeable depending on the age and/or date of filing or assessment. Talk to your attorney as to whether your old income tax debt may be subject to discharge.

- When will collections agencies and creditors stop calling me for payments? Once you get an attorney, most creditors will cease contact. When your case is officially filed, they are forbidden by law to contact you further.

- Why do I need an attorney to file for bankruptcy? Filing for bankruptcy can be a complex process, and an experienced Bankruptcy Lawyer can help you make sure you protect as much of your property as possible and discharge as much of your debt as possible.

Trying to deal with overwhelming debt is extremely stressful. If you're considering filing for bankruptcy to lighten the load, don't wait another minute. Robert A. Schwartz and his staff are dedicated to providing bankruptcy assistance and other legal services to help individuals just like you get back on the path to a bright, debt-free future. When you contact the offices of Robert A. Schwartz, you can count on the help of an experienced attorney who will create a customized legal plan to help you solve the stressful legal issues you're facing.

For bankruptcy assistance, including legal advice and more in-depth information about filing for bankruptcy, visit Robert A. Schwartz online or call the office at (583) 334-4270 and schedule a free bankruptcy evaluation today.

About the Business

Have a question? Ask the experts!

Send your question