3 Bookkeeping Tips for Medical Practices

In the medical industry, keeping track of small details is key. However, this doesn’t only apply to health care operations; it also rings true when taking care of your bookkeeping tasks. If you’re hoping to keep track of your medical practice’s finances, use the following CPA-approved tips to your advantage.

How to Manage Your Medical Practice’s Finances

1. Schedule Profit & Loss Reports

Profit and loss statements offer a glance at the general overview of your financial status. They are often used by large corporations, but they’re just as valuable for small- to medium-sized medical practices.

These reports reveal how much money is coming in and how much you are losing on supplies and other expenses. They also show how much of the daily revenue goes toward the practice’s overall profit. By tracking these amounts, you can assess where you need to cut costs or how your income could be put to better use.

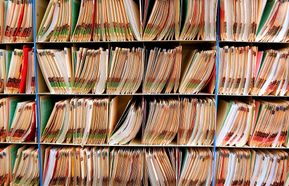

2. Keep All Records

When you collect co-payments from patients and payouts from insurance providers, you should keep a detailed record of these transactions. For the best bookkeeping results, keep both paper and digital copies.

When you collect co-payments from patients and payouts from insurance providers, you should keep a detailed record of these transactions. For the best bookkeeping results, keep both paper and digital copies.

You’ll have a backup of receipts and invoices to reference if your hard drive or cloud program malfunctions. These records will come in handy at the end of the year, whether you’re going over your finances or preparing for tax season.

3. Take Taxes Right Away

Whenever taxes are involved in your practice, such as sales taxes from a patient’s purchase or income tax bills, take them out or set them aside automatically. Holding onto amounts you’ll end up owing the government will only mean more work later on.

If you extract them as you go, you won’t have to worry about sorting through months of transactions at the end of the year. This will also prevent your income from looking higher than it is and altering your profit and loss calculations.

If you’re looking for more helpful tips on bookkeeping, turn to Erie & Associates, P.C. This certified public accountant serves clients in Texarkana, TX, helping them sort through business income and prepare for tax filing. They prioritize open communication and personalized service, so you can count on trustworthy, attentive guidance. To learn more about their services, visit the website. Call (903) 792-6651 to arrange an appointment.

About the Business

Have a question? Ask the experts!

Send your question