How Replacing Your Roof Could Lower Your Insurance Premium

Investing in a new roof for your home can offer several benefits. It improves your curb appeal, raises your property value, and make your home more energy efficient. However, there’s another advantage that many homeowners aren’t aware of, and it can offset the cost of roof replacement. This service can lower your homeowner’s insurance premiums, saving you money.

How Roof Replacement Impacts Your Insurance Premium

Why Roof Replacement Matters

Your roof is your home’s first line of defense against the elements or any potential damage. If it’s old and weak, it won’t withstand a major storm or incident, allowing wind, rain, and debris to enter your home. You’re likely to file an insurance claim if your property is damaged due to these disturbances.

Having a new, high-quality roof that was properly installed by a professional indicates that you’re a responsible homeowner and the property’s exterior will withstand extreme weather. A new roof reduces your likelihood of filing a claim, which means you’re allowed to pay less each month.

Having a new, high-quality roof that was properly installed by a professional indicates that you’re a responsible homeowner and the property’s exterior will withstand extreme weather. A new roof reduces your likelihood of filing a claim, which means you’re allowed to pay less each month.

How to Make the Most of Your Roof Replacement

If you’re interested in getting a new roof and want to make sure you get the maximum benefit, talk to your insurance agent or a company representative to get their opinion. It’s also important to speak with a professional roofer who can guide you to the materials and types of roofing that are best suited to your neighborhood’s climate and the style of your home.

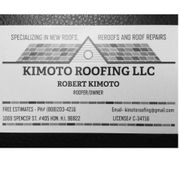

If you’d like to enjoy the benefits of roof replacement, contact the professionals at Kimoto Roofing in Honolulu, HI. This locally owned and operated company provides homeowners and businesses throughout Oahu with a variety of roofing services, including repairs, installation, and home remodeling. Owner Rob Kimoto takes the time to work closely with every customer to ensure you have a positive experience and receive personalized care and service. View their services online, or call (808) 203-4216 to request a free estimate.

About the Business

Have a question? Ask the experts!

Send your question