How a DUI Affects Your Auto Insurance Premiums, From High Risk Insurance Experts

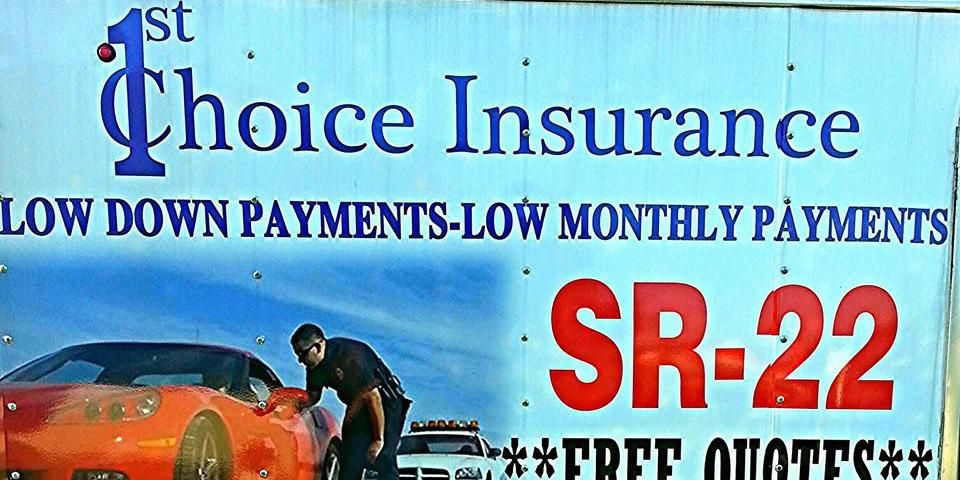

Getting a DUI wreaks havoc in many areas of your life, resulting in heavy fines, suspension of your license, and paying higher car insurance premiums when you are allowed to drive again. Your driving record always has a lot to do with how much you pay, and car insurance companies consider DUI extremely risky behavior even if you don't cause a car accident. If you've been arrested for driving under the influence, you may need to speak with a high-risk insurance specialist, like First Choice Insurance in Fairfield, OH.

The increase in premium isn't exactly a penalty, so there's no set amount by which your payments could rise. Instead, insurance companies calculate that people who drink and drive are more likely to lead to expensive claims later on, so the amount varies a great deal by individual circumstance. However, even in the simplest case, you can expect your premium payments to rise by several hundred dollars.

If you've been convicted of a DUI, you might be required by the state to file a proof of financial responsibility before you're allowed behind the wheel again. Insurance companies file these forms for you, proving that you're carrying the amount of insurance required by your state. The most common of these is SR-22 insurance, with rates especially for drivers the insurers have decided are “high risk.”

First Choice Insurance's expertise can help you save on your auto insurance, even after a DUI conviction. Visit their website to learn more, or call (513) 860-0666 for car insurance quotes today.

About the Business

(177 reviews)

Have a question? Ask the experts!

Send your question