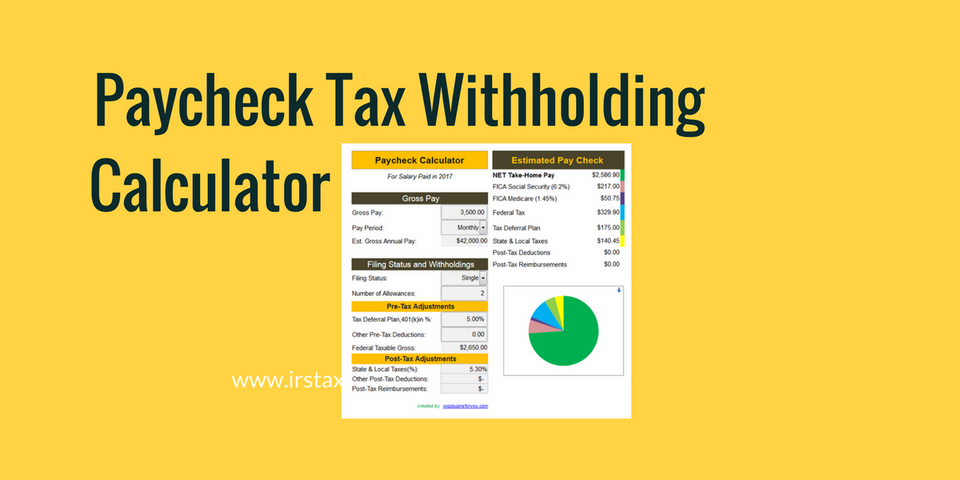

Withholding issues can be complicated, and with the passage of the recent tax reform legislation--most of which takes effect starting in 2018—, it's important to make sure the right amount of tax is withheld for your personal tax situation. As a first step to reflect the tax law changes, the IRS released new withholding tables in January 2018. A revised Form W-4 was released on February 28, 2018. These updated tables were designed to produce the correct amount of tax withholding. This newsletter article provides some guidelines for using the IRS Withholding Calculator found on www.irs.gov to help determine if your paycheck withholding amount is correct.

https://www.sharrardmcgee.com/newsletter.php#9

Your tax advisor at Sharrard, McGee & Co., PA is available to help you with any of your tax planning questions. Call us at (336) 884-0410 in High Point or (336) 272-9777 in Greensboro.

About the Business

Have a question? Ask the experts!

Send your question