For some people, car insurance isn’t exactly easy to negotiate. When you have a less-than-perfect driving record, or simply bad credit, your options can be severely compromised. That’s where independent insurance agencies and agents come in—and where the services offered by First Choice Insurance become invaluable.

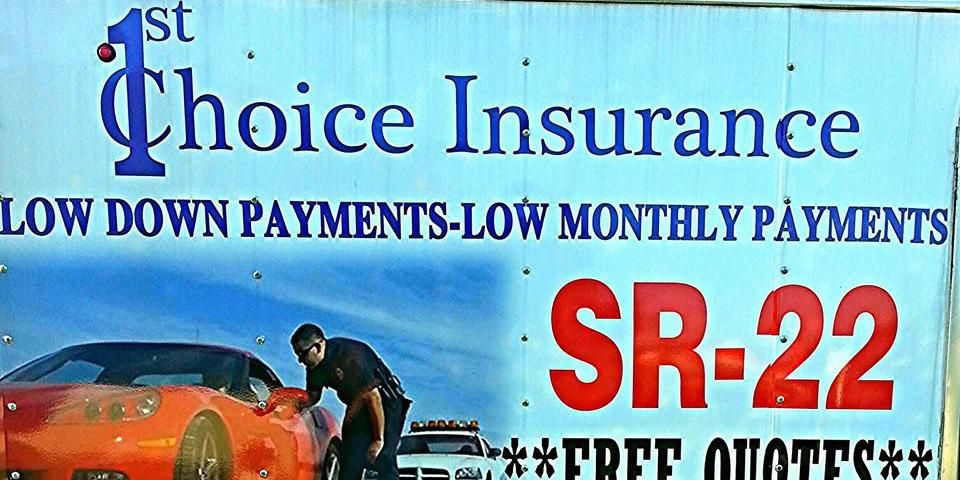

For years, the First Choice Insurance team has been helping people find homeowners insurance, car insurance quotes, and high risk insurance coverage that’s as comprehensive as it is affordable. First Choice Insurance is proud to work with young and suspended drivers, and they’re one of the only local companies to offer SR-22s, which are forms that serve to reinstate driver's licenses after they've been suspended.

What is high risk car insurance? A person doesn’t necessarily have to have any actual strikes against them to fall into a high risk category. Teen motorists, for example, are considered to be a risk, even if they happen to be excellent drivers. And if you have no prior insurance—even if you have a license, but have never owned a car—you’re also considered to be a potential problem. Aside from that, if you have multiple traffic violations or a DWI/DUI, you’re not going to be eligible for a top-of-the-line policy through most companies.

As a family-owned-and-operated company, First Choice Insurance believes in people before everything, and they believe that their clients ought to have the kinds of second chances that great insurance provides. Their team provides motorcycle insurance, recreational vehicle coverage, collision coverage, and everything in between, and they can tailor any policy to accommodate your situation.

To find out more, contact the First Choice Insurance family at (513) 860-0666 and speak to a representative about your options.

About the Business

(177 reviews)

Have a question? Ask the experts!

Send your question