What Your Renters Insurance Does & Doesn't Cover

Most people have renters insurance, but not everyone knows what it does and doesn’t cover. K.L. Smith Agency takes the mystery out of your renter’s policy by providing you with the necessary information upfront. If you live in or near Willimantic, CT, they can assist you with all your insurance needs. Here, they explain what your renters insurance policy actually covers and what’s not included.

What Renters Insurance Covers

Renters insurance covers the value of your personal property in case of theft or fire up to the policy limit. You can choose an actual cash value or a replacement value policy. Only the latter will pay enough money to allow you to repurchase your belongings at the current market value.

Renters insurance policies include personal liability insurance. If you hurt someone or damage their property, this might be covered under your policy. Additionally, if someone gets hurt in your home, your renters insurance may pay their medical bills up to the policy limit.

What Renters Insurance Doesn’t Cover

If your apartment gets flooded because of a natural disaster, your renters insurance won’t pay a dime. If you live in an area prone to earthquakes or other natural disasters, you should consider adding an insurance rider that will cover you.

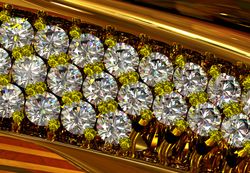

Unless you specifically cover high-priced items, such as jewelry or artwork, your insurance won’t pay for it if it gets damaged. Additionally, if you can’t document the value of your personal possessions, your insurance company won’t cover you. Therefore, it’s a good idea to keep receipts of all high-ticket items in a fireproof safe and take pictures of all your possessions.

Unless you specifically cover high-priced items, such as jewelry or artwork, your insurance won’t pay for it if it gets damaged. Additionally, if you can’t document the value of your personal possessions, your insurance company won’t cover you. Therefore, it’s a good idea to keep receipts of all high-ticket items in a fireproof safe and take pictures of all your possessions.

Are you looking for a new renters insurance policy? Give the staff at K.L. Smith Agency a call at (860) 423-9294. They can also assist you with car insurance as well as life and health insurance. Visit their website to view their full list of services.

About the Business

Have a question? Ask the experts!

Send your question