How Much Car Insurance Am I Required to Carry in Tennessee?

Every state has its own requirements regarding the amount of car insurance it mandates its drivers to carry. Whether you have just moved to Tennessee, are a new driver, or are looking to renew your policy, it’s crucial to be aware of the state’s specific insurance laws. Lafever Insurance Agency helps residents in the Cookeville, TN, area ensure they meet the minimum coverage requirements for operating a vehicle, offering additional options for full protection.

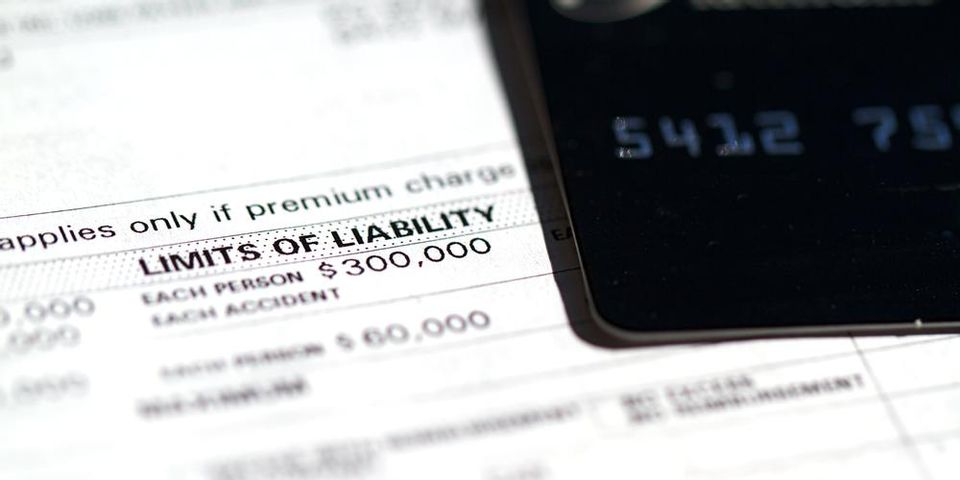

The liability amounts required for drivers in Tennessee are $25,000 for bodily injury, $50,000 for bodily injury affecting two or more people, and $15,000 for property damage. This coverage is meant to pay for the injuries and damages suffered by the party found not at fault in an accident. Failing to purchase the right car insurance limits or not maintaining proof that you have met your insurance requirements while driving are both likely to result in steep penalties.

The liability amounts required for drivers in Tennessee are $25,000 for bodily injury, $50,000 for bodily injury affecting two or more people, and $15,000 for property damage. This coverage is meant to pay for the injuries and damages suffered by the party found not at fault in an accident. Failing to purchase the right car insurance limits or not maintaining proof that you have met your insurance requirements while driving are both likely to result in steep penalties.

Though not mandated by law, there are many other car insurance options that will help protect you if you are ever involved in an accident. Collision and comprehensive coverage come highly recommended, as these policies will provide the funds you need to take care of damages to your own car. Uninsured and underinsured motorist coverage will ensure your needs are met if you are hit by a driver who doesn’t have auto insurance or who lacks the coverage to meet necessary expenses.

Complying with the state’s car insurance requirements will save you quite a bit of money in the long run, should you have the misfortune of being in an accident. Contact Lafever Insurance Agency at (931) 526-3377 to request car insurance quotes, or visit their website for more information.

About the Business

(3 reviews)

Have a question? Ask the experts!

Send your question