What's Inside Your House? How to Make a Home Inventory Before an Insurance Loss Occurs

By FloodCo

While restoring badly damaged homes throughout NW Montana, Floodco's disaster restoration team sees the challenges of fairly adjusting insurance claims. We want you to know that there are big advantages to being more prepared before a property loss occurs.

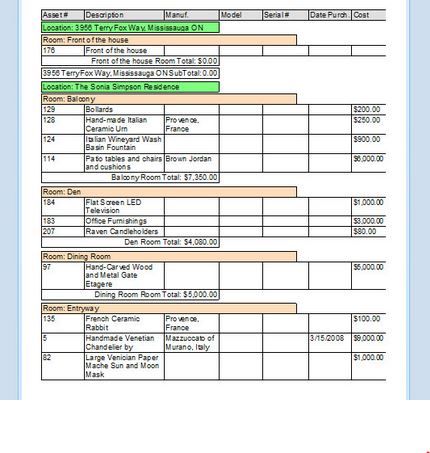

Having a detailed inventory of your home or business' contents can make the difference between a quickly paid insurance claim or a dragged out, contentious claim. It will be very costly to rely only on your memory of what things were there. Creating an inventory before a major loss will also help you know if your contents will be properly insured if the unthinkable happens.

Imagine trying to list every possession you own, along with each item’s worth, when you are stressed out after your home has been destroyed by fire, flood, vandalism or some natural disaster. The task will be overwhelming and virtually impossible. The Adjuster can't do it for you when the house is a smouldering black mess.

According to a recent survey by an insurance industry association over 75% of consumers don’t have any home inventory. Of those who do, many haven’t kept those records up-to-date or don't include the necessary documentation like photos and receipts.

A home inventory can simplify filing an insurance claim, help you secure a settlement and prove useful when verifying property loss for taxes. When you also value your items, a home inventory can also help determine realistically how much insurance you really need. Here are the important things to do to build a home inventory.

1. Find and read your homeowner’s insurance policy (or take it to your agent and sit down for a review of your coverages.)

Less than 5% of people actually read their homeowner’s policy! Only slightly more could locate the policy in a hurry. It is impossible to know what coverage you have without a look at the policy. Start with the definitions section. By law this area of the policy needs to be in plain English, so it explains what the important parts of the policy actually are - in English, not insurance speak. It is good to know:

- Are you covered for the replacement value of your possessions or only a depreciated value- ACV?

- How much is the deductible that you are self insuring on a loss?

Do you have special endorsements for unique items? Examples: Jewelry, heirlooms and family treasures.

- Do you have musical instruments that need to be covered?

- So you have a collection of guns, are they covered?

- Are your golf clubs covered? When you take them to Hawaii?

2. Take some digital photos of the exterior of your home.

Take photos of the outside from all angles. Be sure to photograph landscaping features so it can be rebuilt in the event of loss. Include the outdoor furniture, grills and decor.

Adjusters prefer photos. Videos are inconvenient to refer to and view detail of all items. Photographs are easier to print, email and review.

3. Photograph each interior room from multiple angles.

Take as many pictures as needed to inventory each and every room in your house.Long shots and close ups of art, furniture, fixtures, flooring, window treatments..

4. Open every closet, kitchen cupboard and dresser drawer.

Closets, drawers and storage areas will contain much valuable contents. Photograph valuable items (over $300) separately.

Before you open that drawer, can you mentally list every item inside? You’ll be losing money if you forget anything after a loss.

Build a spreadsheet of the following information about every item in your home:

- When you purchased it

- Where you purchased it

- How much did it cost?

Archive all receipts, if possible. Scan receipts to keep with your home inventory. Keep the receipts of new household purchases in a special folder so you can update your inventory at least annually (tax time is a good time to update).

Clothes and accessories hidden in closets.

Clothes, tools, accessories and jewelry add up to great value. Be sure to take photos of your bedroom closets. Pull out items worth $300 or more and snap a separate photo of that item. List and label.

5. Be sure you record changes after a remodeling project.

Did you get new window coverings or new hardwood floors? Be sure to update your home inventory. Homeowners may never let their agent know about improvements and major purchases of stuff.

6. Photograph model and serial numbers for electronics

Electronics are major purchases with major value. Be sure to photograph (and list) each piece of electronic equipment. Take a photo of the model and serial number plates. Include: TV's, Mobile phones, tablets, stereo equipment, computers, security equipment.

7.Silver, china, crystal items and sets need more documentation.

Lay out a full set of your china to photograph. Take a picture of the front and back of your plates to show the brand and pattern. Then, take of picture of where your china, crystal and silver is stored to show you own the whole set.

Be sure to carefully document gravy bowls, serving dishes and any extra pieces.

8. Take photos of things that can’t be replaced (family photographs, heirlooms, mementos, etc.)

Do you have cherished photographs and family heirlooms? Although these items can’t be replaced, at least you’ll have photos and a "living legacy" of these items if they are destroyed. Think of what's precious.

Be certain to include all rare or high-end items you have been gifted or inherited in your inventory.

9. Head out to the garage.

Take lots of photos here because there will be much of high value.

Document the sports equipment, tools, lawn and garden equipment and misc. household items stored in your garage.

10. Store your home inventory off premises

Keep a copy of your home inventory outside your home, off premises. Use a personal cloud storage service to keep copies electronically. Never save the inventory only on a computer drive that could be destroyed. If you have a bank security box, store a flash drive there as well. Keep your insurance policy in a fire safe.

Want to make this project easier?

- Encircle Inventory App is a free, photo-based app where you take photos with your smart phone to catalog an inventory of items in your home or business.

In closing, the Restoration team at FloodCo deals with the aftermath of property disasters all the time. Valuable furnishings and contents are destroyed or totally unrecognizable following major events, particularly home and business fires. Bad things do happen to good unsuspecting people nearly everyday in the Flathead. It is a fact.

The challenge of determining the value of what was there falls on the insurance adjuster. Coverage disputes arise and claims take longer to adjust. Having detailed records and proper insurance coverage makes great sense. Let us know if you need any encouragement. We'll be glad to tell you about some of our customers who learned the hard way! Call or search FloodCo LLC.

About the Business

Have a question? Ask the experts!

Send your question