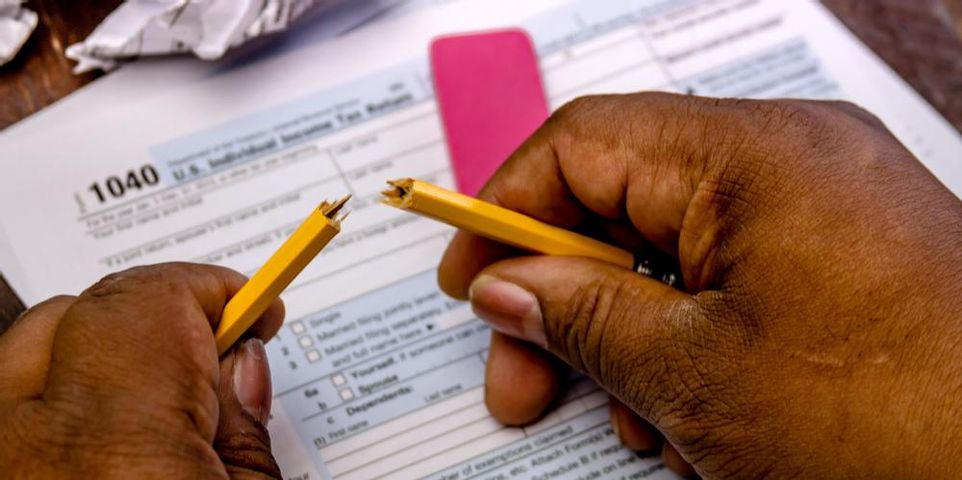

4 Common Tax Preparation Mistakes to Avoid When Filing as a Freelancer

Whether you do freelance work in addition to a 9 to 5 job, or you’ve launched your personal business full-time, keeping track of your finances year-round can make tax preparation a breeze. But, when you’re in charge of setting aside taxes yourself and finding the right deductions, it’s easy to make some mistakes. Simplified Tax in Sparta, WI, has been helping the community with tax preparation for more than 30 years. The tax experts explain mistakes they see freelancers making and how to avoid them.

Common Freelance Tax Preparation Mistakes

1. Not Putting Away Enough From Each Paycheck

Since you don’t have a company automatically taking out federal and state taxes, you’re responsible for doing so yourself. Some freelancers prefer to put funds away during each paycheck, while others opt to do so each month. Either way, if you aren’t putting away about 30% of what you earned, you can face having to pay a lot out of pocket during tax time.

2. Adding Too Many Business Deductions

Self-employed people get the opportunity to write off various expenses pertaining to their business. If you drive to meet with a client, have a home office, or had to purchase a new laptop solely for work, those can be deducted. But, avoid getting carried away — trust the experts to help you find the best deductions for you.

Self-employed people get the opportunity to write off various expenses pertaining to their business. If you drive to meet with a client, have a home office, or had to purchase a new laptop solely for work, those can be deducted. But, avoid getting carried away — trust the experts to help you find the best deductions for you.

3. Not Reporting All Your Income

Maybe you had a one-time client that paid $1000 during the entire year, which is nothing compared to what you earned from other clients. Or, that one company never gave you a 1099 form back. No matter how small you may think an income was or how hidden you might think it is, you should always report anything that totals more than $600 during the year to prevent needing an audit.

4. Having Poor Record Keeping

Even when working with an accountant, if someone doesn’t have their invoices, receipts, or 1099s together, it can slow things down. You’ll need to know exactly what you made from each client you’ve worked with throughout the year and what business expenses you took and why. If you aren’t prepared to file properly, poor record keeping could result in an IRS audit down the line.

For all of your tax preparation and accounting needs in the Sparta, WI, area, trust Simplified Tax to help. Whether you need accounting services, like payroll, for your business or are a freelancer filing taxes for the first time, the experts will walk you through the entire process. To see a full list of services they offer, visit them online or call (608) 269-2633 for more information.

About the Business

Have a question? Ask the experts!

Send your question