How to Plan Your Homeowners Association's Reserve Funding

By HMI

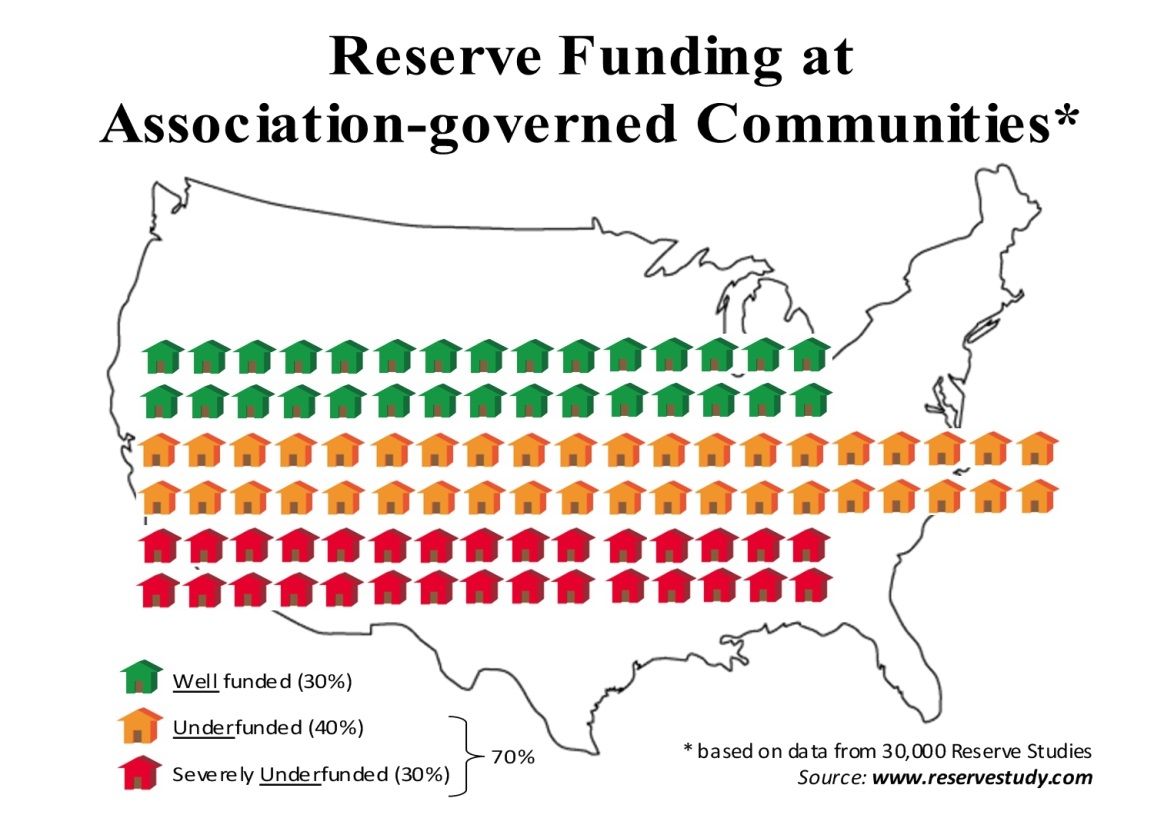

Sitting on the board of a Homeowners or Condominium Association means assuming a great deal of responsibility; one of the most significant of which is managing the Association's reserve funding. Without proper management, the Association may lack sufficient reserves for the proper replacement or maintenance of Association property, which may depress property values and the spirit of the community. Hara Management, Inc., Central Florida’s leading Association Management firm, recommends the following tips when thinking about funding your Association’s reserves.

First, develop a needs assessment so your Board has a clear idea of Association property that will require funding in the future, including inspections to determine how much more useful life remains. Avoiding surprises is the first step to a stable funding plan. A financial analysis should also be conducted, with a 20-30 year projection of expected funding needs.

Many Associations decide to invest their reserve funds, a strategy which has its benefits and risks. If you do decide to invest the funds, follow a path of fiscal conservatism. Even if some investment plans offer potentially higher returns, they aren't worth the risk. Government bonds and CDs are the only viable options.

The long-term implications of insufficient reserve funds can harm the homeowners, the Association, and the entire community. The Association will have to either increase assessments or borrow money, both of which may turn away new buyers.

Hara Management, Inc. has vast experience helping Associations effectively manage their financial reserves. Whether you just need accounting support or are interested in a full-service Association or Property Management services, they have the expertise to make sure your Association is properly funded. Visit their website for more information or call (407) 628-1086.

About the Business

Have a question? Ask the experts!

Send your question